6 Simple Techniques For Hard Money Georgia

Wiki Article

An Unbiased View of Hard Money Georgia

Table of ContentsExcitement About Hard Money GeorgiaHard Money Georgia Fundamentals ExplainedNot known Incorrect Statements About Hard Money Georgia The Greatest Guide To Hard Money GeorgiaHard Money Georgia - Questions

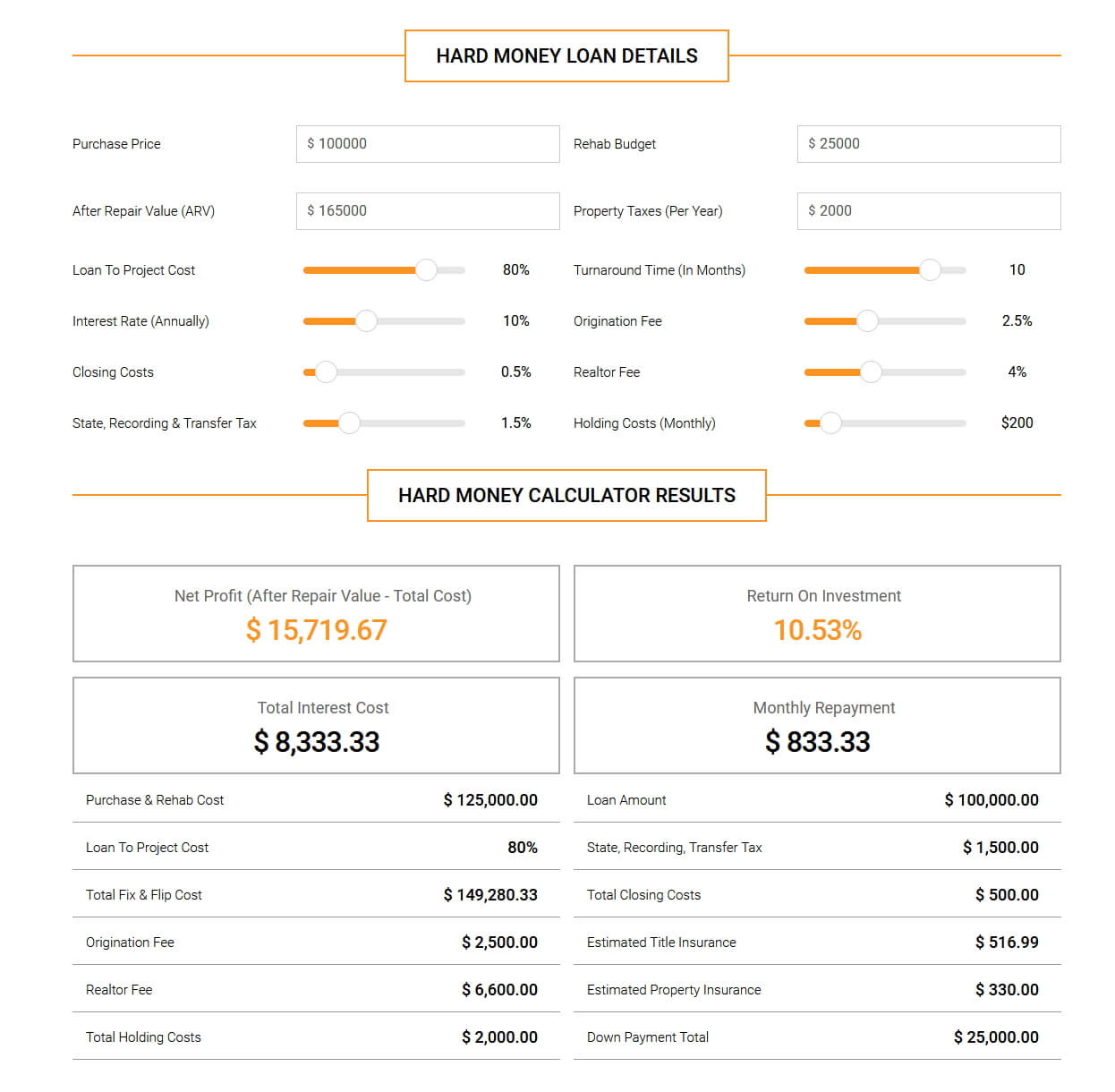

, are short-term loaning tools that genuine estate capitalists can utilize to fund an investment task.There are two primary disadvantages to consider: Hard money financings are hassle-free, but capitalists pay a cost for obtaining this method. The rate can be up to 10 portion points greater than for a standard funding.

As an outcome, these lendings feature much shorter settlement terms than standard home loan. When choosing a tough cash lender, it is necessary to have a clear concept of just how quickly the residential or commercial property will come to be successful to make sure that you'll have the ability to pay off the loan in a prompt fashion. There are a number of excellent factors to think about obtaining a hard cash funding instead of a conventional mortgage from a bank.

Hard Money Georgia - Truths

You may be able to tailor the repayment schedule to your requirements or get particular charges, such as the source cost, decreased or removed throughout the underwriting process. With a tough money lending, the building itself typically functions as security for the loan. Yet once more, lenders might permit capitalists a little bit of freedom below.Hard money financings are an excellent fit for wealthy capitalists that need to obtain financing for an investment property promptly, with no of the red tape that accompanies financial institution funding. When assessing tough cash loan providers, pay attention to the charges, rate of interest prices, and loan terms. If you end up paying way too much for a tough money lending or reduce the repayment duration too short, that can influence just how rewarding your genuine estate endeavor is in the lengthy run.

If you're wanting to get a home to flip or as a rental building, it can be testing to obtain a traditional mortgage. If your credit report score isn't where a traditional lender would like it or you need money extra rapidly than a lender has the ability to provide it, you might be unfortunate.

Getting My Hard Money Georgia To Work

Hard money car loans are temporary secured finances that use the property you're acquiring as collateral. You won't discover one from your bank: Hard money financings are supplied by alternative loan providers such as individual capitalists and private firms, who generally forget mediocre credit history as well as various other financial variables and rather base their choice on the property to be collateralized (hard money georgia).

Tough cash lendings supply several advantages for customers. These include: From i loved this begin to finish, a difficult cash funding might take just a couple of days.

It's crucial to think about all the risks they subject. While hard cash car loans included advantages, a borrower has to likewise consider the dangers. Among them are: Hard money loan providers usually bill a higher rate of interest because they're assuming even more risk than a standard loan provider would. Once again, that's as a result of the threat that a tough money loan provider is taking.

Rumored Buzz on Hard Money Georgia

You're uncertain whether you can manage to settle the tough cash car loan in a short amount of time. You've obtained a strong credit report as well as ought to have the ability to qualify for a traditional financing that most likely brings a lower interest price. Alternatives to hard cash finances consist of standard home mortgages, house equity lendings, friends-and-family financings or funding from the residential property's vendor.

A Biased View of Hard Money Georgia

It is essential to think about elements such as the lending institution's reputation and also rate of interest prices. You might ask a trusted property representative or a fellow home fin for suggestions. Once you've pin down the best difficult cash lender, be prepared to: Create the down payment, which typically is heftier than the down settlement for a standard home mortgage Gather the essential documents, such as evidence of revenue Possibly employ an attorney to review the terms of the lending after you've been authorized Draw up a strategy for paying off the loan Simply as with any car loan, evaluate the advantages and disadvantages of a difficult money loan prior to you devote to borrowing.Regardless of what sort of funding you choose, it's most likely a good idea to examine your cost-free credit rating and also totally free credit scores record with Experian to see where your financial resources stand.

When you listen to the words "difficult money lending" (or "exclusive cash linked here finance") what's the very first thing that undergoes your mind? Shady-looking lending institutions who perform their company in dark streets and also fee overpriced rates of interest? In prior years, some negative apples tarnished the tough cash lending sector when a few predacious lenders were trying to "loan-to-own", supplying very high-risk lendings to debtors using real estate as security as well as intending to confiscate on the homes.

Report this wiki page